How to Calculate Customer Lifetime Value (CLV) for Shopify

CLV tells you how much revenue a customer generates over their entire relationship with your store. Here's exactly how to calculate it—and more importantly, how to increase it.

What is Customer Lifetime Value?

Customer Lifetime Value (CLV)—also called LTV—is the total revenue you can expect from a single customer over the entire duration of their relationship with your store.

It's one of the most important metrics in ecommerce because it tells you:

- How much you can afford to spend acquiring customers

- Which customer segments are most valuable

- Whether your retention strategies are working

- The long-term health of your business

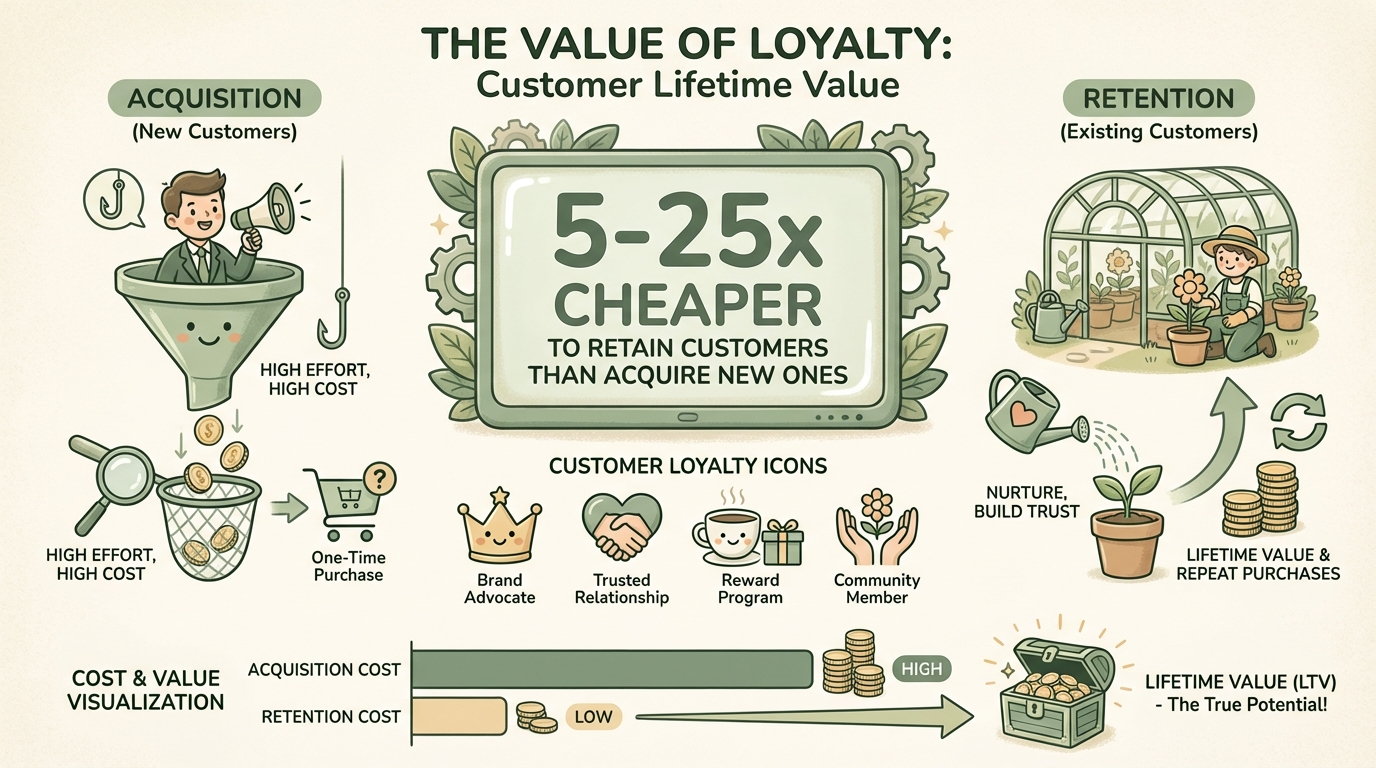

Why CLV Matters

The CLV Formula

The basic formula for calculating customer lifetime value is[1]:

CLV = AOV × Purchase Frequency × Customer Lifespan

Where:

- AOV (Average Order Value) = Total Revenue ÷ Total Number of Orders

- Purchase Frequency = Total Orders ÷ Total Unique Customers

- Customer Lifespan = Average time a customer continues buying (in years)

Let's break down each component and show you exactly how to calculate it in Shopify.

Step 1: Calculate Your Average Order Value

Average Order Value is the simplest component. In Shopify:

- Go to Analytics → Reports → Sales over time

- Select your time period (we recommend 12 months for accuracy)

- Divide Total Sales by Number of Orders

Example:

$500,000 total sales ÷ 6,250 orders = $80 AOV

Quick Tip

Step 2: Calculate Purchase Frequency

Purchase frequency tells you how many times the average customer orders from you in a given period[1].

Formula:

Purchase Frequency = Total Orders ÷ Total Unique Customers

In Shopify:

- Go to Analytics → Reports → Customers over time

- Note your total unique customers for the period

- Divide your total orders by unique customers

Example:

6,250 orders ÷ 5,000 unique customers = 1.25 purchases per customer

Most ecommerce stores see purchase frequency between 1.0-3.0. If yours is below 1.5, there's significant room for improvement through retention strategies.

Step 3: Calculate Customer Lifespan

Customer lifespan is the trickiest component because it requires historical data. There are two approaches[2]:

Method 1: Average Retention Period

Calculate the average time between a customer's first and last purchase:

- Export your customer order history

- For each customer, find time between first and last order

- Average these values

Method 2: Churn-Based Calculation

If you know your annual churn rate, use:

Formula:

Customer Lifespan = 1 ÷ Churn Rate

Example:

If 40% of customers don't return after a year: 1 ÷ 0.40 = 2.5 year lifespan

Industry Estimates

Full CLV Calculation Example

Let's put it all together with a real example[1]:

$70

Average Order Value

Total revenue ÷ total orders

3.04

Purchase Frequency

Orders per customer per year

2.08

Customer Lifespan

Years of active purchasing

$443

Customer Lifetime Value

$70 × 3.04 × 2.08

This store can expect each customer to generate approximately $443 in total revenue over their relationship. This is critical for determining customer acquisition budgets.

CLV:CAC Ratio – The Most Important Metric

Once you know your CLV, compare it to your Customer Acquisition Cost (CAC) to assess profitability[3].

CLV:CAC Ratio = Customer Lifetime Value ÷ Customer Acquisition Cost

What's a Good CLV:CAC Ratio?

| Ratio | Status | What It Means |

|---|---|---|

| < 1:1 | Losing Money | You spend more to acquire customers than they generate |

| 1:1 - 2:1 | Break-even | Barely profitable after other costs |

| 3:1 | Healthy | Standard benchmark for sustainable growth |

| 4:1+ | Excellent | Strong unit economics; room to invest in growth |

| > 5:1 | Under-investing | May be leaving growth on the table |

The 3:1 Rule

“If your LTV:CAC ratio is at least 3:1, you're in a good position to scale. Below that, focus on improving retention before increasing ad spend.”

CLV Benchmarks by Industry

CLV varies significantly by business model and vertical[4]:

| Business Type | Typical CLV Range | Key Driver |

|---|---|---|

| General Retail | $100-$300 | Purchase frequency |

| Fashion & Apparel | $150-$400 | Seasonal repeat purchases |

| Beauty & Cosmetics | $200-$500 | Consumable replenishment |

| Subscription Boxes | $300-$1,200+ | Monthly recurring revenue |

| Luxury Goods | $500-$2,000+ | High AOV, brand loyalty |

| Electronics | $200-$600 | Accessories and upgrades |

Context Matters

How to Increase Customer Lifetime Value

There are three levers for increasing CLV: AOV, purchase frequency, and lifespan[1][2].

1. Increase Average Order Value

Product Bundling

Create bundles that increase cart value while offering perceived savings

Upsells & Cross-sells

Recommend complementary or upgraded products at checkout and post-purchase

Free Shipping Thresholds

Set thresholds just above your current AOV to encourage larger orders

Volume Discounts

Offer tiered pricing that rewards larger purchases

2. Increase Purchase Frequency

Post-Purchase SMS & Email

Stay top-of-mind with timely, personalized follow-up messages

Subscription Options

Offer subscribe-and-save for consumable products

Loyalty Programs

Reward repeat purchases with points, discounts, or exclusive access

Replenishment Reminders

Send automated reminders when products are likely running low

3. Extend Customer Lifespan

Exceptional Customer Service

Resolve issues quickly to prevent churn from negative experiences

Win-Back Campaigns

Re-engage lapsed customers with targeted offers

Community Building

Create emotional connections through social media, content, and events

Personalization

Use customer data to provide relevant product recommendations

The Upsell Advantage

Free CLV Calculator

Don't want to do the math manually? Use our free Customer Lifetime Value calculator to:

- Calculate your current CLV instantly

- See your CLV:CAC ratio health

- Model the impact of increasing repeat purchases

- Get personalized recommendations

Calculate Your CLV Now

Enter your store metrics and see your customer lifetime value in seconds.

Open CLV Calculator →Conclusion

Customer Lifetime Value is the foundation of sustainable ecommerce growth. Without knowing your CLV, you're flying blind on acquisition spend, retention investments, and overall business health.

Key takeaways:

- CLV = AOV × Purchase Frequency × Customer Lifespan

- Aim for a CLV:CAC ratio of at least 3:1

- Focus on all three levers: AOV, frequency, and lifespan

- Post-purchase engagement is crucial for maximizing CLV

- Track CLV over time to measure the impact of retention strategies

For Shopify stores looking to increase CLV, post-purchase SMS upsells are particularly effective—they increase immediate order value while keeping customers engaged for future purchases.

References

- [1] LoyaltyLion. "Shopify Customer Lifetime Value: How to Calculate & Improve CLV". 2025.

- [2] Shopify. "Customer Lifetime Value (CLV): What It Is & How to Calculate It". 2025.

- [3] Corporate Finance Institute. "LTV:CAC Ratio". 2025.

- [4] Shopify Enterprise. "Conversion Optimization & Customer Value Benchmarks". 2025.

Ready to boost your revenue with SMS upsells?

Upsella automatically sends AI-powered SMS upsells after customer purchases. Start your free trial today and unlock hidden revenue effortlessly.